DOGE Price Prediction: Analyzing the Symmetrical Triangle Breakout Potential

#DOGE

- Technical Consolidation: DOGE is forming a symmetrical triangle pattern with critical support at $0.21, indicating potential for a significant breakout in either direction

- Mixed Indicators: While trading below the 20-day MA suggests bearish pressure, the positive MACD histogram and whale accumulation activity signal underlying strength

- Market Timing Opportunity: Current levels may offer entry points for risk-tolerant investors, with key resistance at $0.2479 and support at $0.2065 defining next major moves

DOGE Price Prediction

Technical Analysis: DOGE Shows Mixed Signals Near Critical Support

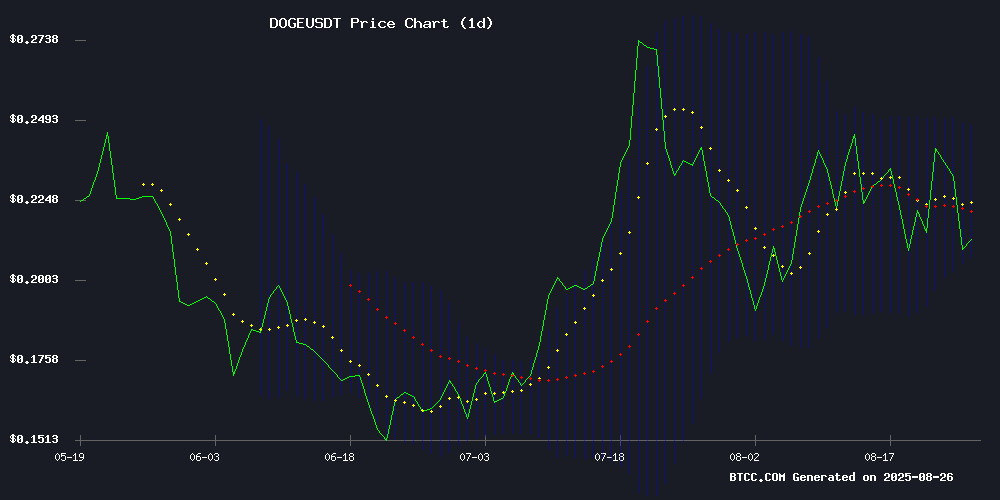

According to BTCC financial analyst James, DOGE is currently trading at $0.21012, sitting just above the crucial $0.21 support level. The price remains below the 20-day moving average of $0.227224, indicating short-term bearish pressure. However, the MACD shows a potential bullish crossover with the histogram turning positive at 0.004250, suggesting weakening downward momentum. The Bollinger Bands indicate consolidation with price hovering NEAR the lower band at $0.206532, while the upper resistance stands at $0.247916.

James notes that a break below $0.206 could signal further downside toward $0.19, while a reclaim of the 20-day MA could target the upper Bollinger Band resistance.

Market Sentiment: Cautious Optimism Amid Accumulation Patterns

BTCC financial analyst James observes that market sentiment toward Doge remains cautiously optimistic despite recent volatility. News headlines highlight the symmetrical triangle pattern formation and the $0.21 support retest, suggesting traders are watching for a potential breakout. While futures open interest declined 8%, the golden cross formation and whale accumulation activity indicate underlying strength.

James emphasizes that the market appears to be in a consolidation phase, with many analysts eyeing a potential breakout toward $0.47 if bullish momentum resumes. The mixed signals reflect typical market indecision during pattern formations.

Factors Influencing DOGE's Price

Dogecoin Price Holds Symmetrical Triangle Pattern Amid Market Indecision

Dogecoin's price hovered near $0.22, maintaining its position within a symmetrical triangle pattern despite a 4% daily decline. The formation—marked by lower highs and higher lows—signals mounting pressure for a decisive breakout. Open interest surged to $1.7 billion, reflecting heightened speculative activity, while trading volume lingered at 98 million.

Analysts note repeated tests of the triangle's lower boundary, each rebound underscoring persistent buyer interest. A breach above the $0.25 resistance level could catalyze upward momentum. Market participants await resolution of this compression, which historically precedes volatile price movements.

Dogecoin (DOGE) Price Prediction: Retesting $0.21 Support—Is a Triangle Breakout Imminent?

Dogecoin's price hovers near $0.22, caught between bullish accumulation and bearish distribution pressures. A 900 million DOGE transfer to Binance sparked selling speculation, yet on-chain data reveals whales added 680 million tokens in August—a vote of confidence amid short-term volatility.

The meme coin mirrors broader crypto market weakness, with risk assets dented by macroeconomic headwinds. Technical patterns suggest a decisive move looms: resistance caps gains at $0.235-$0.25, while $0.213 forms critical support.

If You Missed Early Dogecoin (DOGE) Entry, Don’t Miss This One, Best Cryptocurrency Coin to Buy in 2025?

Dogecoin (DOGE) remains a cultural icon in the cryptocurrency space, famously turning modest investments into fortunes during its 2021 rally. Priced near $0.22, it continues to hold a top-10 market cap position but has seen diminished growth momentum since its peak. Investors are now scouting for the next high-potential entry point.

Mutuum Finance (MUTM) emerges as a contender, attracting attention with its DeFi utility, whale activity, and robust tokenomics. The project is positioning itself as a potential successor to DOGE's early-day gains, with analysts flagging it as one to watch for 2025.

Dogecoin Price Holds $0.22 Amid Market Volatility as Traders Eye $0.47 Breakout

Dogecoin (DOGE) demonstrates resilience despite a 3.38% daily dip to $0.2279, with trading volume surging 84% to $3.53 billion. The meme coin's 1.3% weekly gain underscores its ability to weather market turbulence.

Analysts identify critical levels for DOGE's next move. BitGuru notes $0.20-$0.21 as crucial support, with $0.255 acting as a make-or-break resistance point. A breakout could signal momentum toward $0.47, while failure may prolong sideways action.

The volume spike reveals heightened trader interest despite short-term price pressure. Dollarcurrency21 observes long-term patterns developing in DOGE's price action, suggesting potential for significant movement as market conditions evolve.

DOGE Futures Open Interest Dips 8% Despite Golden Cross Formation

Dogecoin's rally to $0.25 faltered as whale transfers to Binance sparked distribution pressure. A 900 million DOGE move ($200M+) to exchange wallets raised concerns about near-term selling, though on-chain data shows whales accumulated 680 million tokens in August—signaling long-term conviction.

Price action turned volatile, with DOGE swinging 8% between $0.23-$0.25 before settling lower. The reversal coincided with broader risk-off sentiment fueled by hawkish central bank commentary and trade policy headlines. Futures open interest slid 8%, reflecting cooling speculative interest despite the token maintaining its golden cross pattern on higher timeframes.

Key technical levels are now in focus. The $0.23 support zone held during the selloff, but failure to reclaim $0.25 resistance leaves DOGE vulnerable to further consolidation. Binance remains the epicenter of activity, with institutional accumulation and exchange inflows creating a tug-of-war between short-term traders and strategic buyers.

Dogecoin (DOGE) Price Stalls Near $0.22, While Whales Accumulate New Crypto for 25x Potential

Dogecoin (DOGE) has been range-bound near $0.22 for months, failing to sustain a breakout despite minor rebounds. Technical analysts highlight a breakdown in its rising wedge pattern, triggering profit-taking and reinforcing its sideways trajectory. The memecoin’s stagnation mirrors pre-rally consolidation phases seen in 2017 and 2021, but this time, whales are diverting attention elsewhere.

Large investors are quietly accumulating an undisclosed new cryptocurrency, signaling a shift toward assets with higher utility and growth potential. While DOGE treads water, the market’s focus is pivoting to emerging opportunities—where speculative momentum meets tangible use cases.

Is DOGE a good investment?

Based on current technical and fundamental analysis, DOGE presents a high-risk, high-reward investment opportunity. The cryptocurrency is testing critical support at $0.21 while forming a symmetrical triangle pattern that typically precedes significant breakouts.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $0.21012 | Neutral |

| 20-day MA | $0.227224 | Bearish (Below) |

| MACD Histogram | +0.004250 | Bullish Crossover |

| Bollinger Position | Near Lower Band | Oversold Potential |

| Support Level | $0.206-$0.210 | Critical |

BTCC financial analyst James suggests that risk-tolerant investors might consider accumulation near current levels with strict risk management, while conservative investors should wait for a confirmed breakout above $0.227 or below $0.206 for clearer direction.